Bank of Baroda Net banking Login Portal provides seamless online banking services for your convenience. Bank of Baroda Net banking helps you to manage your finances effortlessly.

Access your accounts anytime, anywhere, and take control of your money with ease. Bank of Baroda Net banking offers secure transactions and user-friendly features.

Experience hassle-free fund transfers, bill payments, and account inquiries from the comfort of your home or on the go. Bank of Baroda Net banking ensures the safety of your transactions and sensitive information.

Stay connected to your finances effortlessly with Bank of Baroda Net banking’s intuitive interface. Sign up today to access the convenience of Bank of Baroda Net banking and simplify your banking experience.

Trust Bank of Baroda Net banking for all your online banking needs. Experience the power and convenience of Bank of Baroda Net banking today.

Also Read: SBI Net Banking Login and Activation Process

Table of Contents

About Bank of Baroda known as (BOB)

Bank of Baroda, a leading financial institution, offers a wide range of banking services to meet your needs. At Bank of Baroda, the bank prioritizes your financial well-being.

With Bank of Baroda, managing your money is simple and convenient. Whether you need to save, invest, or borrow, Bank of Baroda has solutions tailored to you.

Experience seamless online banking with Bank of Baroda’s user-friendly interface. Access your accounts anytime, anywhere, and take control of your finances effortlessly.

From savings accounts to loans and investments, Bank of Baroda has you covered. Trust Bank of Baroda for all your banking needs and experience excellence in banking services.

How to Activate Bank of Baroda Net Banking Login Online?

Activating net banking for your Bank of Baroda (BoB) account allows you to manage your finances easily from home or anywhere with an internet connection. If you’re new to BoB’s online services, here’s a simple guide on how to activate your net banking login:

Keep your BOB net banking user ID handy, which was provided to you at the time of opening your bank account.

To activate your net banking account, you will need to create a log in password. Here’s how:

Option 1: Online Activation

- Visit the official Bank of Baroda website. https://www.bankofbaroda.in/

- Click on the ‘Internet Banking’ button.

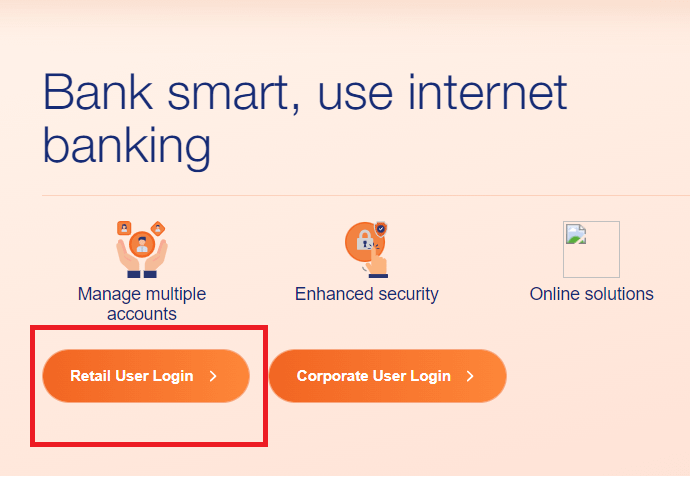

- Once you click on “Internet banking” it will redirect you to the new page now you need to click on “Retail User Login”.

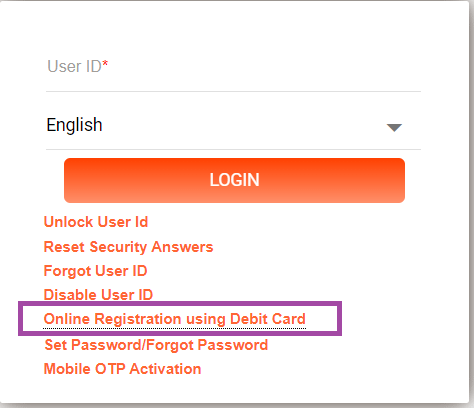

- Once again after clicking on the “Retail user Login” you will be redirected to the new page where you need to click on “Online Registration Using Debit Card” link.

- After clicking on the “Online Registration Using Debit Card” link you need to fill in the debit card details in the given online form and verify your details.

- You will receive OTP on your registered mobile number once you verify the OTP, You can then set up your new login password. Make sure it is strong and secure, combining letters, numbers, and special characters.

How to Register BOB Net Banking offline?

Option 2: Visit Branch

To start using internet banking, first download the right form from the homepage. Just click on “Download Application Form” and choose either the form for personal accounts (retail users) or business accounts (corporate users). You can also pick up a form at your local branch.

Personal Accounts: If you have a personal account, use the retail form.

Business Accounts: If your account is for a business, like a company or partnership, use the corporate form.

Make sure to fill out the form completely and have all required people sign it. For example, if it’s a joint account, all owners need to sign. Then, take the completed form to the bank branch where you have your account.

After the bank processes your form, they will send your User ID to your registered email address. If you don’t receive it, there’s an option called “Forgot User ID” on the BOB World Internet login page that you can use to retrieve it.

Once you have your User ID, you can set up your password. Go to the login page and click “Set Password/Forgot Password” to do this.

If you have a bank debit card and want to register for Internet banking without going to the branch, you can do this easily from home or work. Just find the link ‘Online Registration using Debit Card’ on the login page.

After setting up your User ID and password, you’re ready to log in to the website and start using the banking services.

How to do Bank of Baroda Net Banking Login?

Once you activate your BOB net banking, you can log in to the BOB net banking portal and start managing your banking online. Here, we have explained the process of how to log in to the BOB net banking portal:

here is the simple process to log in to BOB Net banking.

- Go back to the BoB net banking page or click here on Login BOB net banking.

- Enter your User ID and the password you have set.

- You might be asked to set security questions or enter additional authentication details for added security on your first login.

- Complete any other setup instructions provided by the bank.

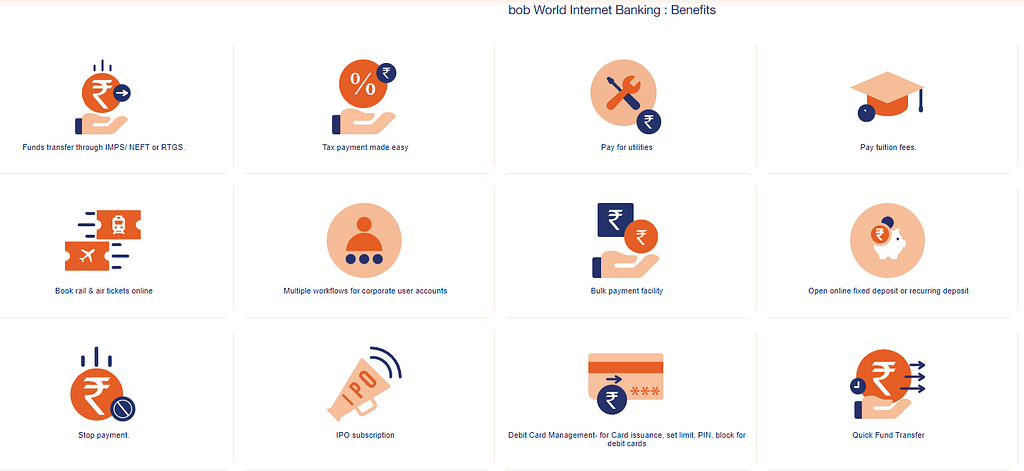

After your first successful login, you can start exploring various net banking features such as:

- Checking your account balances and recent transactions.

- Transferring money to other bank accounts.

- Paying bills and recharging mobile phones.

- Managing your debit/credit cards.

- Requesting new checkbooks, opening fixed deposits, and more.

Tips for a Safe Bank of Baroda Net Banking Login Experience

- Always ensure that you are accessing BoB’s official website and not a fraudulent site.

- Never share your User ID, password, or OTP with anyone.

- Regularly change your password and keep it confidential.

- Log out from net banking when you’re done, especially when using public or shared computers.

How to Apply for a Home Loan, Personal Loan, or Credit Card in Bank of Baroda?

Applying for a home loan, personal loan, or credit card at the Bank of Baroda (BoB) is a straightforward process. Here’s a simple guide on how you can go about it:

What is the Process to Apply for Home Loan at the Bank of Baroda?

Step 1: Check Eligibility – First, check if you qualify for a home loan. Generally, you need to have a regular income, a good credit history, and you must be within a certain age range (usually 21-60 years). Bank of Baroda’s website has a home loan eligibility calculator, which can help you understand how much loan you might get.

Step 2: Gather Required Documents – You will need documents such as identity proof (like an Aadhaar or PAN card), address proof, income proof (salary slips, tax returns), and property documents. Make sure these documents are ready before you apply.

Step 3: Apply for the Loan – You can apply for a home loan either online through the Bank of Baroda website or by visiting a nearby branch. If applying online:

- Navigate to the home loan section.

- Fill out the application form with your details.

- Upload the necessary documents.

- Submit the application.

If you prefer doing it in person, visit your nearest branch, and a bank representative will help you through the process.

Step 4: Loan Processing – After you apply, the bank will review your application and documents. They might call you or visit your property as part of the process. If everything is in order, the bank will approve your loan.

Step 5: Loan Disbursement – Once approved, the loan amount will be disbursed to your account or directly to the property seller, based on the agreement.

How to apply for a Personal Loan at the Bank of Baroda?

Step 1: Determine How Much You Need – Decide how much money you need as a personal loan. Make sure it’s a realistic amount that you can repay considering your income and expenses.

Step 2: Check Loan Details – Visit the Bank of Baroda website or a branch to understand the terms of the loan, like interest rate, repayment period, and any other fees.

Step 3: Complete the Application – Just like with home loans, you can apply for a personal loan online or in person. Fill in the application form, attach the required documents (ID, address proof, income proof), and submit.

Step 4: Wait for Approval – The bank will check your documents and credit history. If all goes well, your loan will be approved.

Step 5: Receive the Funds – Once approved, the loan amount will be transferred to your bank account.

How to apply for a Credit Card at the Bank of Baroda?

Step 1: Choose the Right Card – Bank of Baroda offers various types of credit cards, each with different benefits and features. Choose one that suits your spending habits and needs.

Step 2: Check Eligibility – Make sure you meet the eligibility criteria for the credit card, which usually includes age, income level, and a good credit score.

Step 3: Apply – You can apply for a credit card online at the Bank of Baroda website or by visiting a branch. Fill in the application form, and submit the required documents like ID proof, address proof, and income proof.

Step 4: Approval and Card Delivery – Once your application is approved, the credit card will be mailed to your home address.

What to Keep in mind while applying for a loan or a credit card:

- Always read the terms and conditions carefully before applying for any loan or credit card.

- Ensure your contact details are up to date in the bank’s records to avoid any communication gap.

- Regularly check your loan or credit card status through net banking or mobile banking apps provided by the Bank of Baroda.

By following these steps, you can easily apply for a home loan, personal loan, or credit card at Bank of Baroda, helping you manage your finances effectively.

How to Contact BOB Customer Care?

For Domestic Customer

You can contact Bank of Baroda customer care by calling their 24*7 toll-free number which is 1800 5700 for domestic customers and For Domestic Customers Calling from Abroad (24X7) is +91 79-66296009.

There is also a facility called missed call services you can call this number 8468001111 for balance inquiries and for mini statements you can call 8468001122.

And, for Pradhan Mantri Jan Dhan Yojna and FI schemes, there is a dedicated toll-free number (06:00 am to 10:00 pm) you can call on this number 1800 102 77 88.

For International Customer

NRI’s who are in overseas locations can call +91 79-66296629 and it is available 24*7.

NRI’s who are in India can contact on toll-free number 1800 5700.

And, for Operational guidelines Queries (Only for NRI customers) can email on nribo@bankofbaroda.com this email ID.

And toll-free number for NRI’s from various overseas locations such as: –

- Oman – 80077196

- Kenya – 0800721742

- UAE – 80001830996

- United States – 18445379719

- UK – 08000478340