EMI Calculator: A Comprehensive Guide about EMI Calculator.

EMI Calculator: – In today’s world, financial decisions are becoming increasingly complex. Whether you’re considering purchasing a home, a car, or any other big-ticket item, one of the key factors to consider is the Equated Monthly Installment (EMI). An EMI calculator is a powerful tool that helps individuals understand and plan their finances better. In this article, we’ll delve into what an EMI calculator is, how it works, and why it’s important to use one.

With the help of this EMI calculator, you can calculate Home Loans, Personal Loans, Car loans, etc.

| Year | Month | Principle Amount (₹) | Interest Amount (₹) | Total Interest + Principle (₹) | Balance (₹) | Loan Paid to Date (%) |

|---|

Table of Contents

What is an EMI Calculator?

An EMI calculator is an online tool that helps individuals calculate the monthly installment they need to pay towards a loan. It provides users with an estimate of their monthly repayment amount based on factors such as loan amount, interest rate, and loan tenure. calculators are widely available on financial websites and mobile applications, making them easily accessible to anyone with an internet connection.

How Does Calculator Work?

The functioning of a calculator is relatively simple yet highly effective. Users input three primary parameters into the calculator: the loan amount, the interest rate, and the loan tenure (the duration for which the loan is taken). Once these details are entered, the calculator uses a predefined mathematical formula to compute the monthly EMI amount.

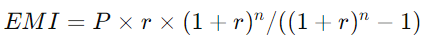

The formula used for calculating EMI is:

Where:

- 𝑃 = Loan amount (principal)

- r = Monthly interest rate (annual interest rate divided by 12)

- 𝑛 = Loan tenure in months

Using this formula, the Calculator quickly generates the monthly installment amount, allowing users to make informed decisions about their finances.

Why is it Important to Use an EMI Calculator?

There are several reasons why using an EMI calculator is essential:

- Financial Planning: A calculator helps individuals plan their finances effectively by providing them with a clear understanding of their monthly financial obligations. It allows them to assess whether they can afford the loan and whether it fits into their budget.

- Comparison: With this calculator, users can compare different loan options by varying parameters such as loan amount, interest rate, and tenure. This enables them to choose the most suitable option that meets their financial needs and requirements.

- Accuracy: Calculating EMI manually can be tedious and prone to errors. A calculator eliminates the possibility of errors and provides accurate results within seconds, saving time and effort.

- Visualization: Calculators often provide users with a graphical representation of their loan repayment schedule, making it easier to understand how their payments will progress over time. This visualization can help users make more informed financial decisions.

- Prepayment Planning: Many Calculators allow users to simulate the impact of making prepayments on their loans. This feature helps users understand how additional payments can reduce the loan tenure and save on interest costs.

In conclusion, an EMI calculator is a valuable tool for anyone considering taking a loan. It provides users with accurate, easy-to-understand information that empowers them to make informed financial decisions. By using a calculator, individuals can plan their finances effectively, compare loan options, and visualize their loan repayment schedule, ultimately leading to better financial health and well-being.

Read Also: How to Activate Internet Banking