SBI Net Banking Login Portal gives you the facility to manage your finances easily. With SBI Net Banking, you can access your bank account online anytime, anywhere. Transfer money, pay bills, and check your balance with just a few clicks.

It’s convenient and secure, allowing you to handle your banking needs without visiting a branch. Whether you’re at home or on the go, SBI Net Banking gives you control over your money. Plus, it’s simple to use, even if you’re not technically good.

Just log in with your username and password, and you’re ready to go.

Say goodbye to long queues and paperwork – SBI Net Banking is here to make your life easier. Sign up today and experience the convenience of banking at your fingertips with SBI Net Banking.

About State Bank Of India known as SBI

State Bank of India, the largest public sector bank in India, offers a comprehensive range of banking services to meet your financial needs.

With the State Bank of India, managing your money is convenient and hassle-free. Access your accounts anytime, anywhere, and take control of your finances effortlessly.

State Bank of India provides secure transactions and user-friendly features for your peace of mind.

Whether you need savings accounts, loans, or investment options, State Bank of India has solutions tailored to you. Trust State Bank of India for all your banking needs and experience excellence in customer service.

Join the State Bank of India today and discover a world of financial opportunities. State Bank of India: Your trusted partner in banking for generations.

Table of Contents

How to Activate SBI Net Banking Login?

Are you a State Bank of India (SBI) customer wanting to start using net banking? It’s a great way to handle your banking needs from home or while on the go. Net banking lets you check your account balance, transfer money, pay bills, and more, without having to visit the bank. Here’s a simple guide on how to activate your SBI net banking.

7 Easy Steps to Activate SBI Net Banking Login

Step 1: Get Your Account Details Ready – First, make sure you have your SBI bank account number and your registered mobile number handy. These are essential for setting up your online banking.

Step2: Visit the Official SBI Website – Visit official SBI website – https://retail.onlinesbi.sbi/retail/login.htm

Step 3: Register for Online Banking – Click on “Continue to Login”

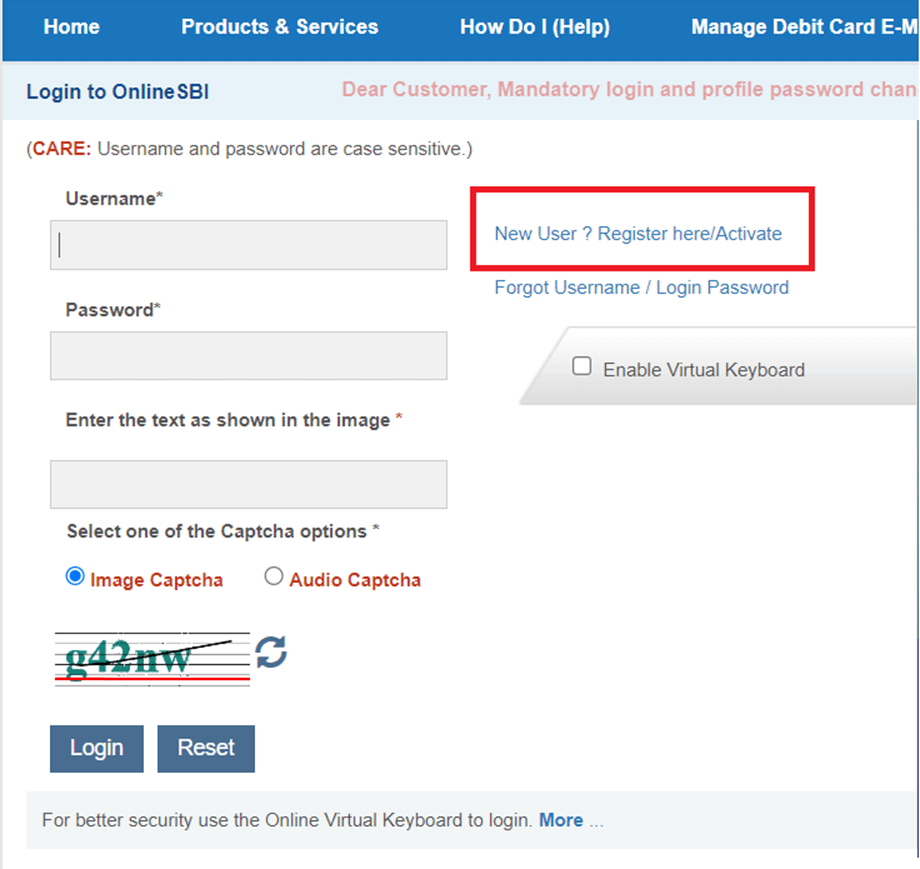

Step 4: Fill in the Required Information – You will see a Login section and at the left, you will see a link “New User? Register here Activate” Click on that link.

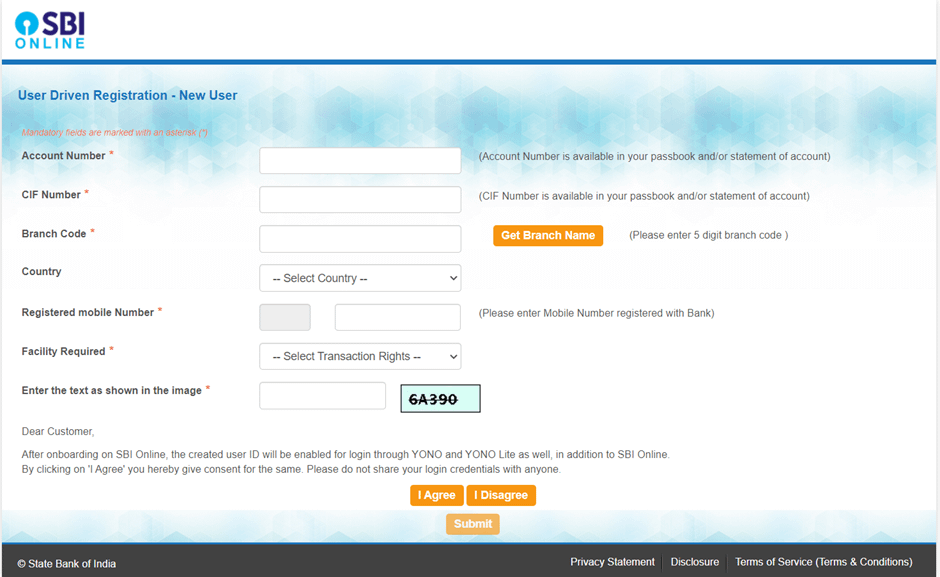

Once you click on that link you will be redirected to a new page where you need to fill in the required details such as account number, branch code, CIF number, country, registered mobile number, etc.

After filling in the required details click on “submit”.

Step 5: Receive Your OTP – After you submit the form with all the correct details, you will receive a One-Time-Password (OTP) on your registered mobile number. Enter this OTP in the space provided on the website to proceed.

Step 6: Set Your Username and Password – Once your OTP has been successfully verified, you will be asked to choose a username and password for your net banking account. Make sure your password is strong – use a mix of letters, numbers, and special characters.

Step 7: Complete Your Registration – After all these steps, your registration and activation of SBI net banking are complete. You can now start using all the online banking services offered by SBI.

Always remember to log out from your net banking session when you’re done to keep your account secure. Never share your login, password, or OTP with anyone. If you face any issues during the registration process, you can call SBI customer service for help or visit your nearest SBI branch.

How to do SBI Net Banking Login?

Logging into your State Bank of India (SBI) net banking account is straightforward and quick. By following these simple steps, you can access your banking details, make transactions, and manage your finances online without having to visit the bank. Here’s how to do it:

Step 1: Visit the Official SBI Website – Open a web browser on your computer or mobile device. Type the official SBI website address (https://retail.onlinesbi.sbi/retail/login.htm) into the address bar and press Enter. It’s important to make sure you are visiting the official site to avoid any security risks.

Step 2: Find the Login Section – Once the SBI homepage loads, look for the “Continue to Login” section. You will usually find this on the left side of the page.

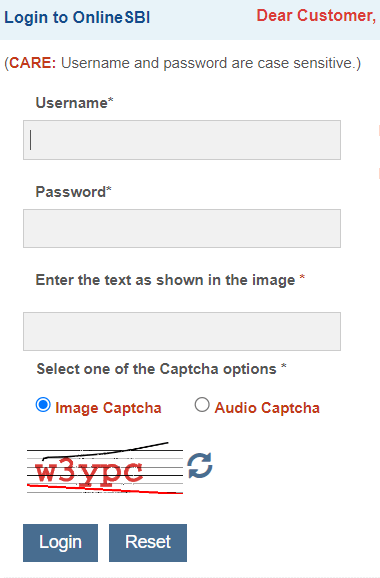

Step 3: Enter Your Username and Password – You will now see a login page asking for your username and password. These are the details you created when you registered for SBI net banking. Type your username in the first field and your password in the second field. Make sure to enter them carefully to avoid any errors.

Step 4: Solve the Captcha – For security reasons, SBI might ask you to solve a captcha. This is a simple test to prove that you are not a robot. Follow the instructions on the screen, which usually involve typing the letters and numbers you see in an image into a text box.

Step 6: Click on the ‘Login’ Button – After entering your username, and password, and solving the captcha, click on the “Login” button to access your account.

Step 7: You’re In! – If all your details are correct, you will be taken to your net banking dashboard. From here, you can view your account balance, make transactions, pay bills, and much more.

Tips for a Safe SBI net Banking Login Experience

- Always make sure you are logging in from a secure internet connection.

- Never share your username and password with anyone.

- Always log out from your net banking account after you have finished your session to prevent unauthorized access.

- Regularly update your password to help keep your account secure.

- If you encounter any problems while trying to log in, such as forgetting your password or username, look for the “Forgot Password” or “Forgot Username” links on the login page. These will guide you through the steps to recover your account access.

- Logging into your SBI net banking is as easy as that! By using these online services, you can manage your finances efficiently and effectively from the comfort of your home or while on the go.

How to Apply for a Home Loan, Personal Loan, or Credit Card in State Bank of India?

Applying for a loan or credit card from State Bank of India (SBI) can be straightforward. Whether you need a home loan, a personal loan, or a credit card, SBI offers a variety of options. Below, I’ll guide you through the process of applying for each one using simple steps.

1. Applying for a Home Loan in SBI

A home loan helps you buy or build your dream house. Here’s how to apply for an SBI home loan:

- Step 1: Check Your Eligibility – First, make sure you are eligible for a home loan. SBI requires you to have a steady source of income and a good credit history. You can check your eligibility on the SBI website or by visiting any SBI branch.

- Step 2: Gather Necessary Documents – You will need several documents to apply for a home loan, including proof of identity (like your Aadhaar card or passport), proof of address, recent salary slips if you are employed, business proofs if you are self-employed, and property documents.

- Step 3: Fill Out the Application Form – You can apply online via the SBI website or visit a branch. Fill in the application form, attaching all the required documents.

- Step 4: Discuss Loan Details – Once your application is submitted, an SBI official will contact you to discuss the loan amount, repayment period, interest rate, and other details.

- Step 5: Approval and Disbursement – If your application is approved, SBI will sanction your loan and disburse the amount either in full or in installments, depending on the agreement..

2. Applying for a Personal Loan

A personal loan can help you in a financial crunch, used for any personal expenses.

- Step 1: Verify Eligibility – Like home loans, you need a stable income and a good credit score to qualify for a personal loan. Check the specific requirements on the SBI website.

- Step 2: Prepare Documents – Prepare your identity proof, address proof, and income proof documents. You might also need bank statements and employment details.

- Step 3: Application – Apply online through the SBI net banking portal or by visiting your nearest branch. Fill in the personal loan application form and submit it along with the necessary documents.

- Step 4: Loan Processing – SBI will review your application and documents. They might call you for a discussion or request additional documents.

- Step 5: Loan Approval and Disbursement – Once approved, the loan amount will be credited to your bank account.

3. Applying for a Credit Card

Credit cards are useful for making secure transactions and managing short-term finances.

- Step 1: Select the Right Card – SBI offers various credit cards tailored to different needs. Visit the SBI website to find the card that suits your lifestyle and spending habits.

- Step 2: Check Eligibility – Each card has specific eligibility criteria listed on the website. Generally, you need a stable income and a good credit score.

- Step 3: Apply – You can apply for an SBI credit card online or at an SBI branch. Fill out the application form and submit it with the required documents such as ID proof, address proof, and income proof.

- Step 4: Credit Card Approval – After reviewing your application, if everything is in order, SBI will approve your credit card application.

- Step 5: Receive Your Card – Your SBI credit card will be mailed to your registered address. You will need to activate it as per the instructions provided with the card.

General Tips:

- Always read the terms and conditions of any loan or credit card carefully.

- Ensure all the information you provide is accurate to avoid any issues with approval.

- Keep track of your application status online if applied through the SBI website.

- By following these steps, you can smoothly apply for a home loan, personal loan, or credit card from SBI, helping you manage your financial needs effectively.