PNB Net banking login portal, e-banking, mobile banking, and personal banking are online platforms where existing users of PNB bank can manage their banking things online without visiting the branch.

PNB Net banking login portal is a secure and easy-to-use platform. In this article, we will explore how to apply for net banking in PNB, how to apply for home loans and personal loans also, we will understand how we can apply for a credit card.

Table of Contents

About PNB (Punjab National Bank)

The full form of PNB is Punjab National Bank. PNB is a government public sector bank and it was founded in May 1984.

PNB has branches all over India, which helps us to get in touch with PNB representatives easily as it is available across the country.

this bank keeps your money safe and secure. And PNB also provides loans if you need them. For example, if you need a loan for buying a house, starting a business, or for personal reasons, you can ask PNB bank for a loan, and PNB bank will provide it after verifying your documents. You can pay back the amount in simple and easy EMIs.

How to Activate PNB Net Banking Login Portal

Activation of PNB Net Banking is a simple task and easy to use. To avail of net banking services, you should have a bank account with PNB Bank.

Before activation of PNB net banking make sure your documents submitted with the bank are up to date and your Aadhaar card and mobile number is linked to your PAN card.

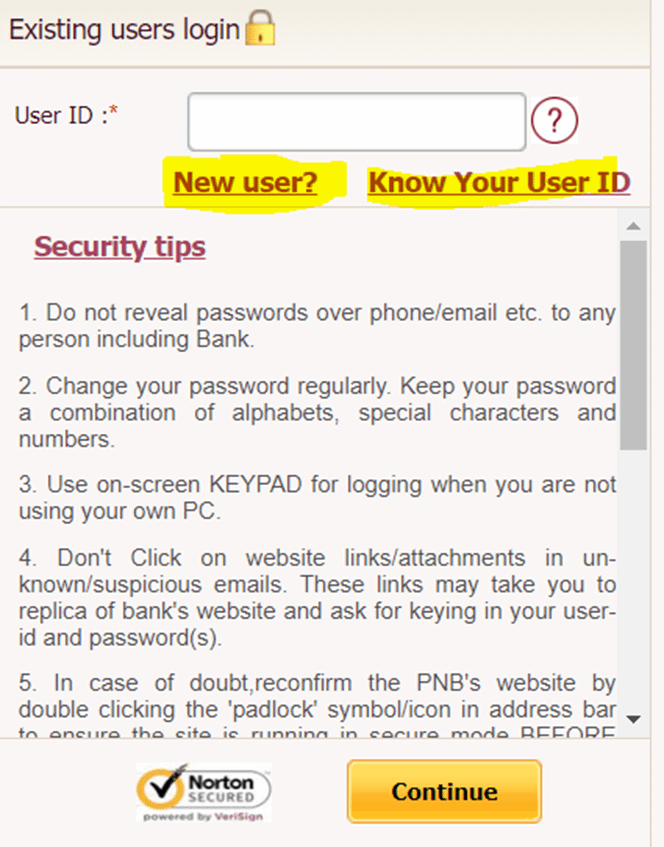

To activate PNB net banking you should have the User ID. If you do not have you can retrieve the user id very easily.

Know your User ID

- Visit the PNB bank website.

- Click on “Retail Internet banking”.

- And then click on “Know your User ID”.

- Provide the account number, DOB, or PAN card number and click on “Verify”.

- That’s all. You have received your user ID on your registered mobile number or it will be displayed on your computer or mobile.

- Follow the below process to activate PNB net banking online.

Activate PNB Net banking Login Portal- For Retail Banking

- Firstly, visit PNB’s official website https://netpnb.com/

- Now, click on “Retail Internet Banking”.

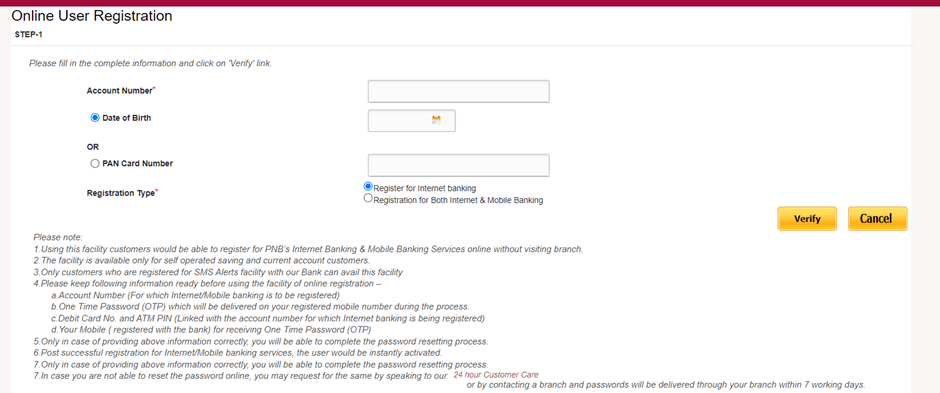

- Once you click on “Retail Internet Banking” a new login page will open where you will click on “New User”.

- Here you will get two options to register with for PNB net banking one is through a Debit card and the second is with Aadhar OTP. You can choose according to your convenience.

- Once you click on any one of the above statements, you will be redirected to the registration page where you need to provide your account number, date of birth, or PAN card.

- And, then you need to select the registration type whether you want to register for Internet banking or register for both Internet and mobile banking.

- After providing all the details you can click on “verify” and after that you will receive an OTP on your registered mobile number.

- Enter the OTP in the given space and click on “Continue”.

- After that, you will be required to provide debit card details and then click on “Continue” again.

- Now, you need to set your login and transaction password.

- Finally, read and accept the terms and conditions of using Internet banking and then click on “Complete Registration”.

- That’s all you need to do. You have successfully activated PNB net banking.

Activate Net banking – For the corporate user

For corporate users, there is only one way to activate Internet banking and that is you need to visit the PNB branch to avail of the net banking facilities. You can download the PNB 1212 form and submit this to your nearest PNB bank branch. Once your documents are verified. You will receive an Internet banking Kit.

PNB Net Banking Login Procedure

After activation of the PNB Net banking system, you can use your user ID and password to log in to PNB Net banking. Here we have given the tutorial on how you can log in to PNB net banking easily.

- Visit PNB bank’s official website https://netpnb.com/

- Click on “Retail Internet Banking”

- Enter your “User ID”

- Click on “Continue”

- Enter your password and click on “log in”. Thats all you need to do.

- You have successfully logged in to your PNB Net banking portal

How to Apply for a Home Loan, Personal Loan, or Credit Card in Punjab National Bank?

PNB bank offers a variety of loans to their users such as home loans, personal loans, business loans, mortgage loans, etc. If you need cash or want to buy a car or a home PNB can help you to fulfill your dreams.

Applying for Home Loans at PNB Bank: A Simple Guide

PNB Bank offers an opportunity for individuals to achieve their dream of owning a home through its home loan services. If you’re considering buying a house and need financial assistance, PNB Bank could be the right choice for you. Here’s a straightforward guide on how to apply for a home loan at PNB Bank:

How to Apply for a Home Loan in PNB Bank:

- Research and Prepare: Before applying for a home loan, it’s essential to research and understand the various loan products offered by PNB Bank.

- Check Eligibility: Visit the PNB Bank website or contact your nearest branch to check the eligibility criteria for a home loan. Generally, eligibility depends on factors such as age, income, employment status, credit score, and property value.

- Consolidate Documents: Prepare the necessary documents required for the home loan application process. Visit the bank to know the document requirements.

- Consult with Loan Officer: The loan officer will guide you through the application process, explain the terms and conditions, and assist you in filling out the application form.

- Submit Application: Once you are satisfied with the offer and filled the form you can submit it along with the required documents to the loan officer.

- Verification and Processing: PNB will take some time to verify the documents and. The bank may also conduct a valuation of the property you intend to purchase.

- Loan Approval: Once the verification and processing are complete, PNB Bank will notify you of the loan approval decision. If your application is approved, you will receive a loan offer detailing the terms and conditions, including the loan amount, interest rate, tenure, and EMI amount.

- Acceptance and Disbursement: Review the loan offer carefully and accept it if you agree to the terms. Upon acceptance, PNB Bank will disburse the loan amount to the seller or builder of the property.

- Repayment: Start repaying the home loan EMIs as per the repayment schedule provided by PNB Bank. Ensure timely payment to avoid any penalties or default.

By following these simple steps, you can apply for a home loan at PNB Bank and turn your dream of owning a home into reality.

A Comprehensive Guide to Applying for Personal Loans at PNB Bank

Personal loans offer a flexible financial solution for individuals to meet various needs, from funding emergencies to fulfilling personal aspirations. PNB Bank, a trusted name in banking, provides a seamless process for obtaining personal loans. This comprehensive guide outlines the steps to apply for a personal loan at PNB Bank in detail, making the process simple and accessible to all.

Understanding Personal Loans:

Before diving into the application process, it’s essential to grasp the fundamentals of personal loans. These loans are unsecured, meaning borrowers don’t need to pledge collateral. They can be used for a range of purposes, including medical expenses, home renovations, education fees, debt consolidation, or even planning a vacation.

Step-by-Step Guide to Applying for a Personal Loan at PNB Bank:

- Research Loan Options: Research before applying for any loans. You can check it on the PNB bank website or consult the online customer care of PNB bank they will tell you the available loan products, interest rates, loan amounts, tenure, and eligibility criteria.

- Check Eligibility: Check eligibility for personal loans. Each bank has different criteria for Eligibility for personal loans. Use PNB Bank’s online eligibility calculator or consult with a loan officer to assess your eligibility.

There are two ways to apply for personal loans.

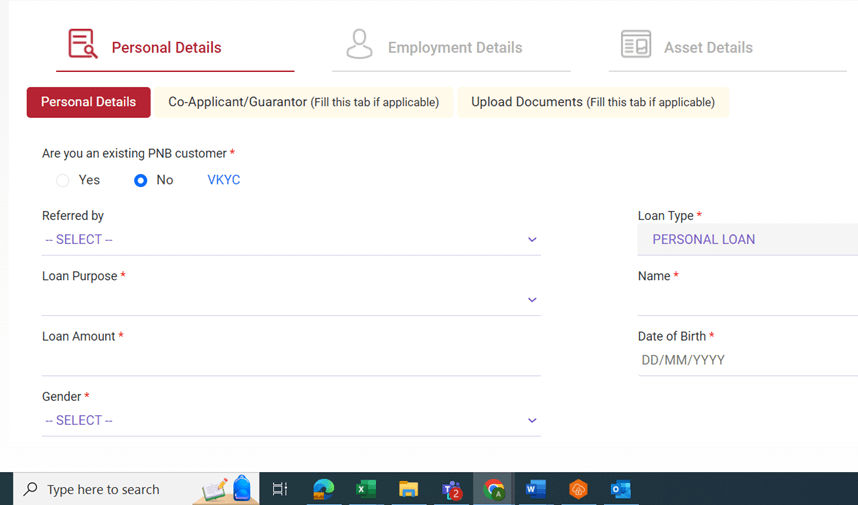

Apply for an Online personal loan in PNB bank

PNB Bank offers Online banking services to avail their banking features online. You can follow the below steps to apply for online personal loans from PNB Bank.

Visit here https://www.pnbindia.in/personal.html

Select your loan requirements category such as “Personal Loan Scheme For Life Insurance Corporation (LIC) Of India Employees”, “Personal Loan Scheme For Doctors”, “Personal Loan Scheme For Pensioners”, and “Personal Loan Scheme For Public”.

Click on any one of the links as per your requirement.

Once you click on the link it takes you to the loans page where you need to provide some details.

Apply for Offline personal loan in PNB

- Visit PNB Bank Branch: Once you have all the required documents in order, visit your nearest PNB Bank branch to initiate the personal loan application process or visit the bank website for the online application process.

- Complete Application Form: Fill out the personal loan application form provided by PNB Bank. Provide all necessary details truthfully and accurately. Double-check the form to ensure there are no errors or missing information.

- Submit Application and Documents: Submit the completed application form along with the required documents to the loan officer. Ensure that all documents are neatly organized and legible. The loan officer will verify the documents and initiate the processing of your loan application.

- Verification and Processing: PNB Bank will conduct a thorough verification of the documents submitted and assess your eligibility for the personal loan.

- Loan Approval: Once the verification and processing are complete, PNB Bank will notify you of the loan approval decision. If your application is approved, you will receive a loan offer outlining the loan amount, interest rate, tenure, and repayment schedule.

Documents Required for Personal Loan in PNB

Prepare the necessary documents required for the personal loan application. Commonly requested documents include:

- Identity Proof (e.g., Aadhaar card, PAN card, passport)

- Address Proof (e.g., Aadhaar card, utility bills)

- Income Proof (e.g., salary slips, income tax returns)

- Bank Statements

- Any additional documents specified by PNB Bank

Applying for a personal loan at PNB Bank is a straightforward process that can be easily navigated by following the steps outlined above. By understanding the eligibility criteria, gathering the necessary documents, and collaborating with the bank’s loan officers, individuals can access the financial assistance they need to achieve their goals and aspirations. If you have any questions or require assistance during the application process, don’t hesitate to reach out to PNB Bank’s customer service team for guidance and support.