BOI Net Banking Login portal offers various features online. You just need to have a BOI net banking login ID and password. To get BOI net banking user ID and password you can read this article. We have explained in detail how to activate and log in to BOI net banking and other features of the Bank of India.

Table of Contents

About Bank of India

Bank of India, founded in 1906, is one of India’s oldest and most trusted banks. It offers various services like personal and corporate banking. Customers of this bank can easily reach out to the bank as this bank has branches and ATMs all over the country.

Bank of India makes banking convenient through its online net banking and mobile App services. It also supports businesses with customized financial products.

Internationally, it has a presence in key financial centers, helping Indian businesses abroad. The bank focuses on customer satisfaction, transparency, and ethical practices.

Bank of India also contributes to community development through initiatives in education, healthcare, and the environment. It’s a reliable institution, playing a vital role in India’s economic growth.

How to Activate the BOI Net Banking Login Portal?

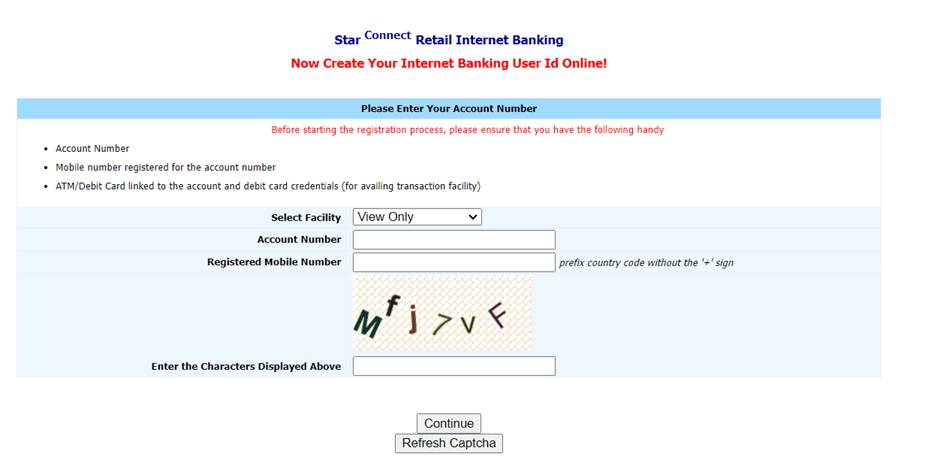

To activate BOI net banking, follow the process outlined below. In this tutorial, we’ve compiled the information and explained it in simple ways to help you easily set up net banking with the Bank of India.

- Firstly, visit the Bank of India website – https://bankofindia.co.in/

- Click on “Internet Banking”

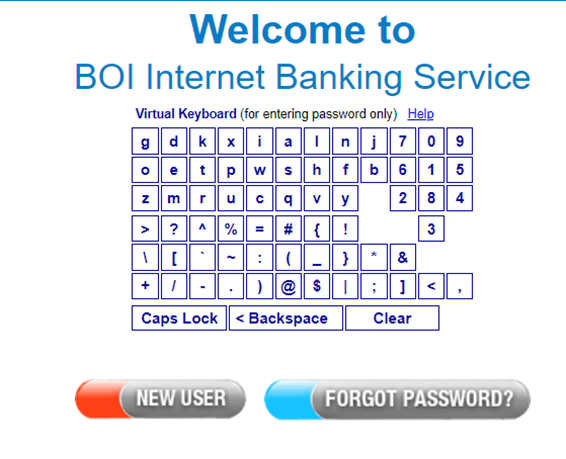

- Once, you click on “Internet Banking” you need to select “Personal banking.” And after clicking on this a new window will be opened where you need to click on “new user”.

- Now, you should have an account number, registered mobile number, ATM/Debit card linked to the account, and debit card credentials (for availing transactions facility) with you at the time of net banking registration.

- After filling in all the required details, click on “Continue”.

- Now, you will receive an OTP on your registered mobile number.

- Enter the OTP. After successful verification, you need to create a password.

- Once you set up the password, complete the registration process as per the given instructions on the screen.

- That’s all you need to do. You have successfully registered net banking in the Bank of Inda.

How to Login BOI net Banking portal?

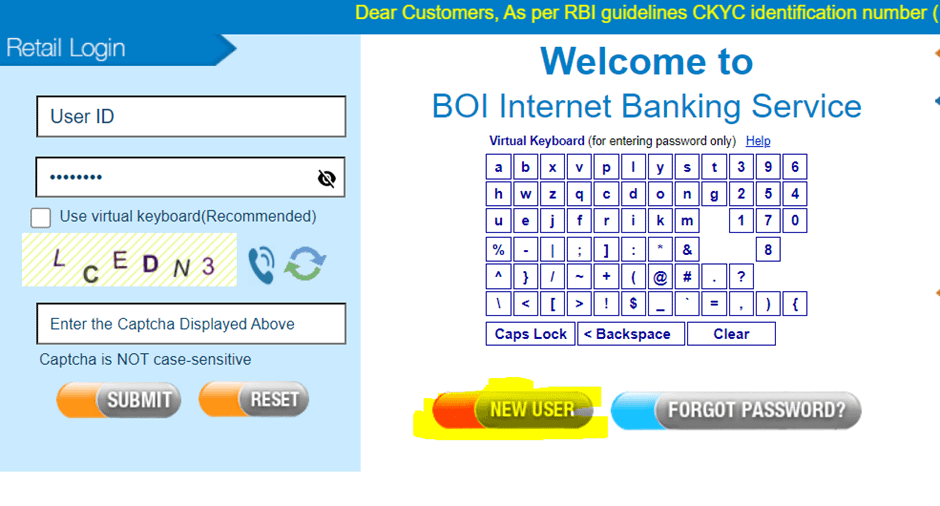

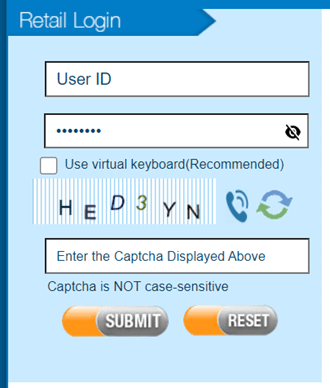

After the successful registration of net banking, you can log into the BOI net banking portal anytime anywhere to access your online net banking.

Below, we have given the step-by-step process to log in to net banking.

- Visit here, https://bankofindia.co.in/

- Click on Internet banking.

- Select personal banking.

- Accept terms & conditions.

- Enter your User ID and Password and click on submit.

- That’s all, you have successfully logged in to your BOI net banking portal.

How to Reset / forgot Net banking password in Bank of India?

If you have forgotten your net banking password, you can easily reset your account. Just need to follow a few steps and you can reset the password.

- Visit the bank’s official website. (link given above).

- You will see a “forgot password” button on the login portal.

- Click on the “forgot password” button.

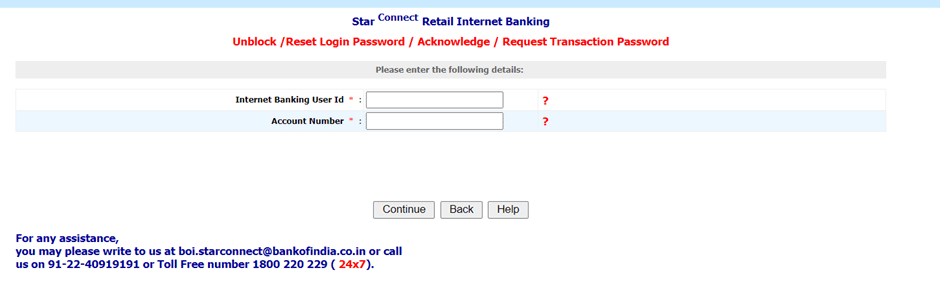

- A new window will be displayed. Where you need to provide the banking user ID and account number.

- Now, after providing your details you can click on “Continue”.

- You will get a one-time password on your registered mobile for verification.

- Verify your OTP. Now you will be redirected to the new page where you need to set up a new net banking password.

- Once you set up a new password for your net banking, you can use this password to log in BOI net banking portal anytime anywhere.

BOI mobile banking APP

Bank of India now has launched its mobile banking app. You can use it on your phone to access your bank account information.

It works just like using your bank account on a computer.

You get the same information and can perform similar things, like checking your balance or transferring money.

It makes managing your money easier because you can do it from your phone anytime, anywhere.

Download the BOI mobile app from the Google Play Store if you’re using an Android device. If you’re using an iPhone, you can download it from the Apple Store.

Simply type “BOI mobile banking app” in the search bar, and you’ll find the BOI mobile app. Click on “download” and install the app.

Next, you need to set up your account.

You can register for the mobile banking app by providing your mobile number and verifying it through a one-time password.

That’s all you need to do. You have successfully registered for BOI mobile banking services.

How to Apply for a Home Loan, Personal Loan, or Car Loan, in the Bank of India?

In today’s world, everyone dreams of having their own home and car. Bank of India makes this possible for you through its easy loan process.

In this article, we explain in a simple method how you can easily apply for loans at the Bank of India and what things you should keep in mind before applying for any kind of loan.

Additionally, we will share ideas on how you can pay off your home loan before the scheduled period.

Home Loan

To apply for a home loan from the Bank of India, you can follow the below steps.

Online Process

- Visit the bank website type “Bank of India home loan” and click on search.

- Once you are on the bank website you can find the 5 types of home loans are there on the website. 1 STAR HOME LOAN. 2, STAR DIAMOND HOME LOAN. 3, STAR SMART HOME LOAN. 4, STAR PRAVASI HOME LOAN. 5, STAR HOME LOAN – FURNISHING.

- Choose the home loan type as per your requirement and check the eligibility, document requirements, and loan repayment tenure.

- fill out the application form and submit it.

- Once, your documents are verified by the bank, you will get a call from a bank representative for further processing.

- If you are an eligible customer for a home loan, the bank will section the loan after completing all the required processes.

Offline Process

The offline process for home loans is very simple. you just need to visit the nearest Bank of India bank branch and ask at the reception for a home loan counter.

Once you find the Home loan counter, you can ask the representative available there that you are looking for a home loan.

After that representative will ask you to fill out the home loan form and one home loan salesperson will be assigned to you for your help.

What documents are required for a Home loan in the Bank of India?

To apply home loan you need to have below documents: –

For Individual

- Identity proof such as PAN card, Passport, Driving license, and Voter ID Card.

- Proof of Address such as Passport, Driving license, Aadhaar Card, electricity bill, telephone bill, and piped gas bill.

- Proof of Income for a salaried person – 6-month salary slip, pay slip, one-year ITR/ form 16. and for self-employed – last 3 years ITR with computation of Income profit and loss account balance sheet, capital account statement.

for Non-Individuals

- For non-individual customers below documents are required: –

- KYC of the Director/Partner.

- PAN card of the Company/Firm.

- MOA/AOA Registered Partnership Deed.

- Certificate of Incorporation.

- last 12 months of Bank statements.

- Last 3 Years Audit report for the company/Firm.