Table of Contents

UAN Login: UAN Activation & EPFO Login Steps

UAN Login and the EPF login portal help you to manage your EPF account online. With UAN login and the EPF login portal, you can easily track EPF withdrawals, update KYC information, add nominees, and download the EPF passbook.

UAN, also known as the Universal Account Number, is unique to each individual. Even if you change jobs multiple times, you should maintain only one UAN number.

When you switch to a new organization, provide them with your UAN number and request them to deposit EPF contributions into this same UAN. This way, you can easily keep track of your employee provident funds.

Both portals offer various facilities: EPF login enables you to download and check your EPF contributions, while UAN login allows you to request EPF withdrawals, track requests, and update bank details, Aadhaar, and PAN details.

The Employees Provident Fund Organization known as EPFO was established by the Ministry of Labour and Employment on March 4, 1952. EPFO offers various services to employees who are working in non-governmental organizations such as retirement plans, insurance, and provident funds.

In this article, we have explained in detail how to do an EPF login, UAN login, activate the UAN number, how to withdraw epf amount, how to track epf claim status and update KYC.

Once you activate your UAN number you need to log in to the EPF portal to access your EPF account where you can check EPF contributions and manage transactions online.

Read also: – How to Activate SBI Internet banking and Login?

How to Activate UAN number?

UAN Activation is the initial step to access all the features of EPFO (Employee’s Provident Fund Organization). To activate your UAN, you must have the UAN number provided by your employer.

If you do not have your UAN number, you can follow the steps below to retrieve it. This process is straightforward and helps you easily know your UAN number.

Know your UAN Number

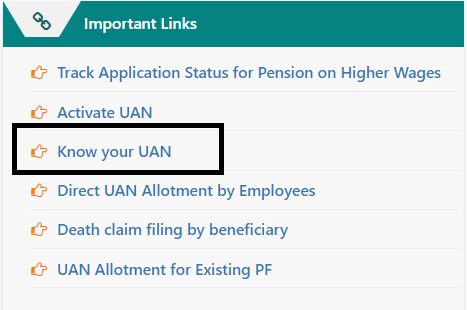

- First, you need to visit this website https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Now, Click on “Know your UAN“.

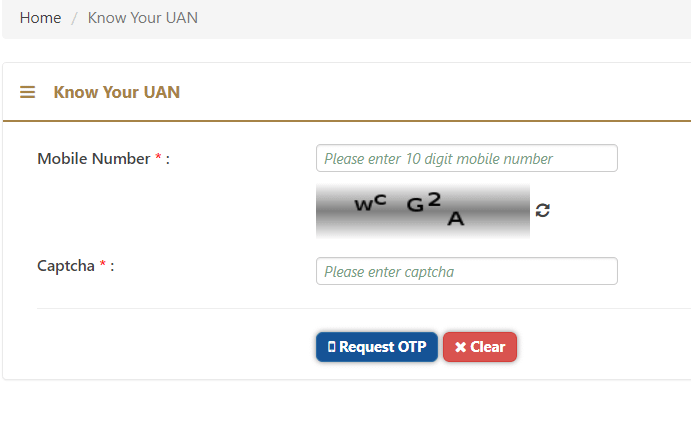

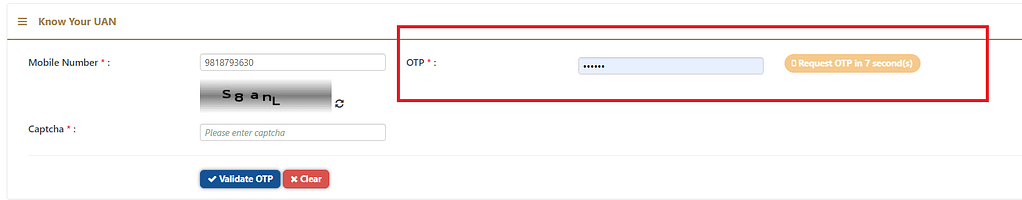

- A new page will open where you need to provide the registered mobile number to request the OTP.

- After providing the mobile and entering the captcha you need to click on “Request OTP”

- Now, enter the OTP that you have received.

- Once, you enter the OTP it will show your UAN number.

- That’s all you need to do to know your UAN number

Activate UAN number

As we have explained above how to know your UAN Number, Now here we have explained in detail how to Activate your UAN number by using very simple steps.

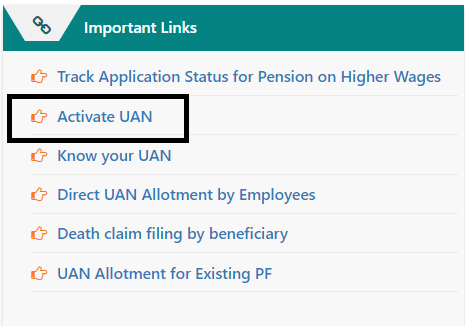

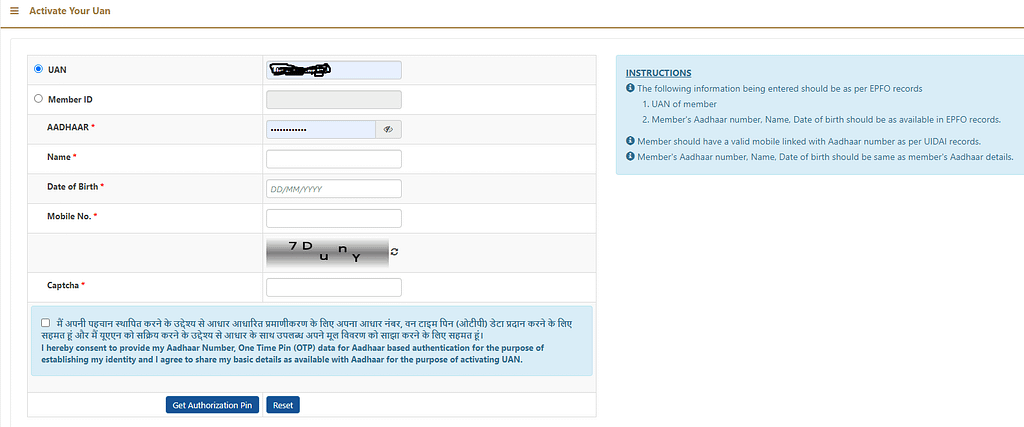

- Visit this website https://unifiedportal-mem.epfindia.gov.in/memberinterface/ and click on “Activate UAN”.

- Once, you click on “Activate UAN” a new page will open where you need to provide a few details.

- Now, you have filled all the required columns. you can click on “Get Authorization Pin”.

- Once, you click on “Get Authorization Pin” an OTP will be sent to your registered mobile number.

- Verify the OTP.

- That’s all you need to do. your UAN Login password will be sent to your registered mobile number.

- You can use that password to login the UAN portal.

How to do UAN Login and EPF Login?

EPF login and UAN login process is a simple task, just follow the instructions to access the EPF portal.

- First of all, visit the official website of the EPFO https://www.epfindia.gov.in/.

- On the very top of the page, you will find the “Services” link and in the dropdown of the “Services” link, you will find the “For Employees” link. Just click on that link.

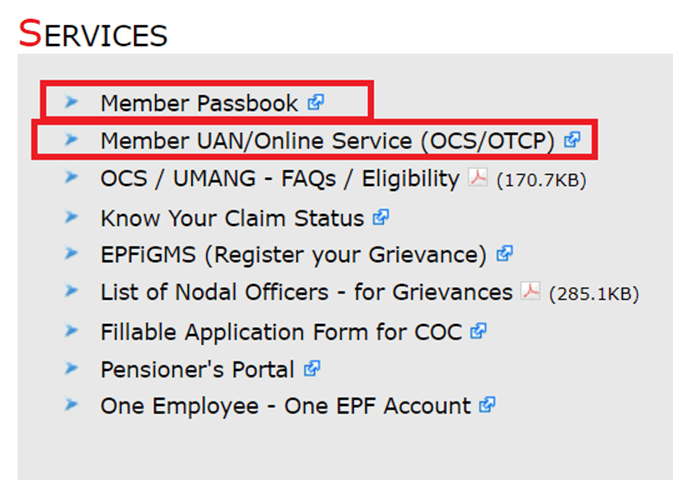

- Once you click on the “For Employees” link it will take you to the new page where you will see a few options.

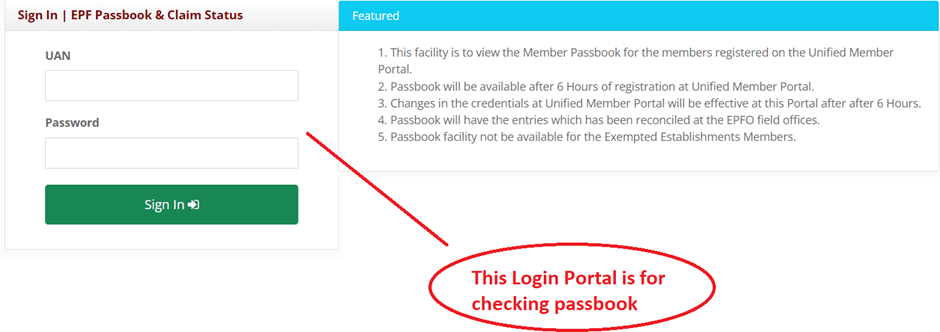

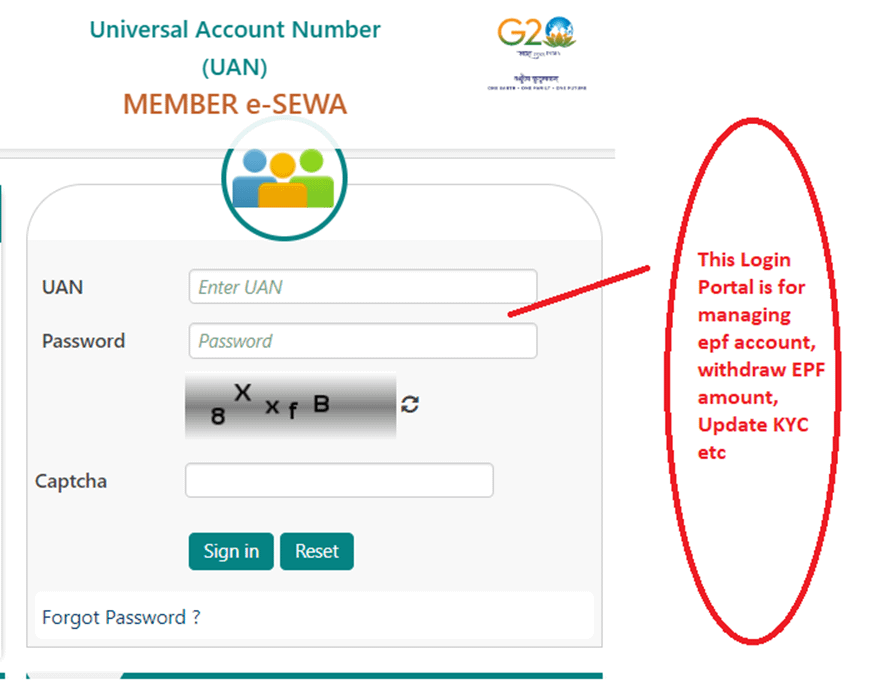

- Now, it’s up to you if you want to check your EPF passbook and check your contributions made by you and your employer then you need to click on “Member Passbook” or If you want to withdraw your EPF amount, update your KYC, and other things then you need to click on “Member UAN/ Online Services (OCS/OTCP)”. (below are the both screenshots)

- Now, you have successfully logged in to your EPF account and UAN account.

How to Download EPF Passbook?

We assume that by now you have completed the entire tutorial provided above on how to obtain your UAN number, activate it, and subsequently log in to the UAN and EPFO portal to access EPF facilities.

Now, below, we have explained how to download your EPF Passbook. The EPF passbook functions similarly to a regular bank passbook, containing all transaction details.

On the passbook, you can find employers, employees, and pension contributions.

Follow the below steps to download the EPF passbook.

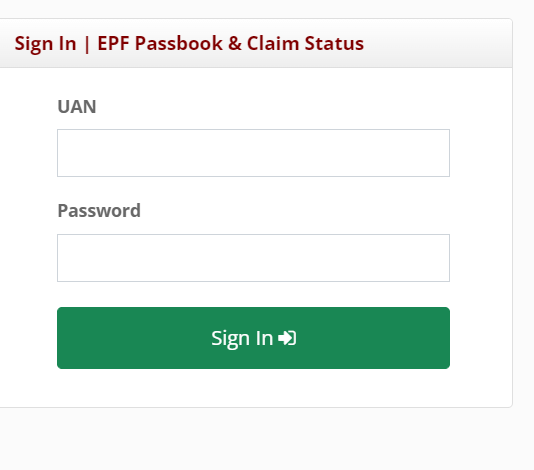

- Enter the UAN number and password

- It will take you to the EPF passbook Login page, where you can keep track of the transactions made by your employer.

- That’s the simple process to log in EPF passbook. Thank you.

Note: Once you have registered your UAN number, it will take 6 hours for your EPF passbook to become available.

How to Withdraw EPF Amount through UAN Login Portal?

It is very important to update your KYC details before applying for EPF withdrawal to avoid any complications in the process.

Ensure that your bank account, Aadhaar card, and PAN card are linked, and all necessary documents are updated on the EPFO portal.

Keep in mind that you cannot withdraw the full EPF amount while you are working in the organization. You are only eligible for full EPF withdrawal when you exit the organization.

You can only withdraw a partial amount if needed. Read the instructions and guidelines for withdrawals.

follow below steps to withdrawal EPF amount.

- First, log into your UAN member portal (explained above how to do a UAN login, follow that process to log into the UAN member portal).

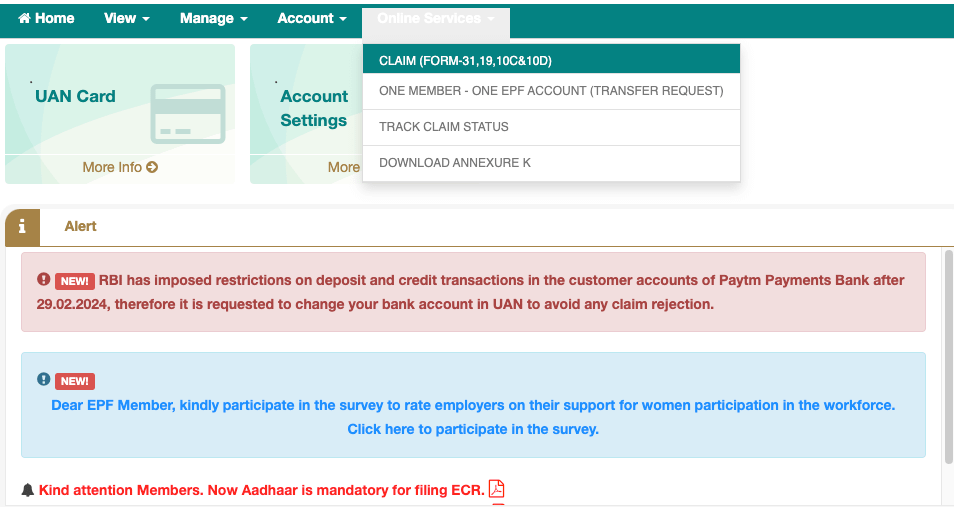

- Go to the on “Online Services” dropdown and select “Claim Form 31, 19, 10C & 10D). (refer below screenshot).

- Once you click on “Claim (form 31, 19, 10C & 10D)” as new page will be opened where you need to verify your bank account number by providing you bank account number in the required space. make sure your bank account is linked with aadhaar card.

- Now, click on “Verify”. and then click “Proceed for Online Claim”.

- After that a new page will popup where you need select the”PF Advance form-31″.

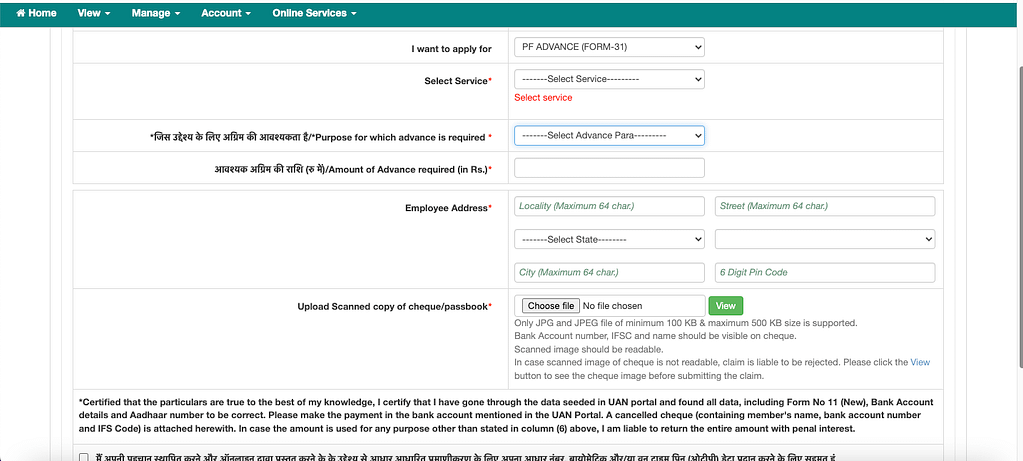

- Now, a form will open for you to fill where you need select the reason for epf withdrawal, required amount for withdrawal, address and upload the scanned copy of the cheque book.

- After providing all the required details you can tick mark on the check box and click on “Get aadhaar OTP” to verify your details.

- That’s all you need to do. You have successfully registered the request for EPF Withdrawal.

How to Track EPF Claim Status through UAN Login Portal?

Track EPF claim status in just 2 steps. follow below tutorial to track your claim status online.

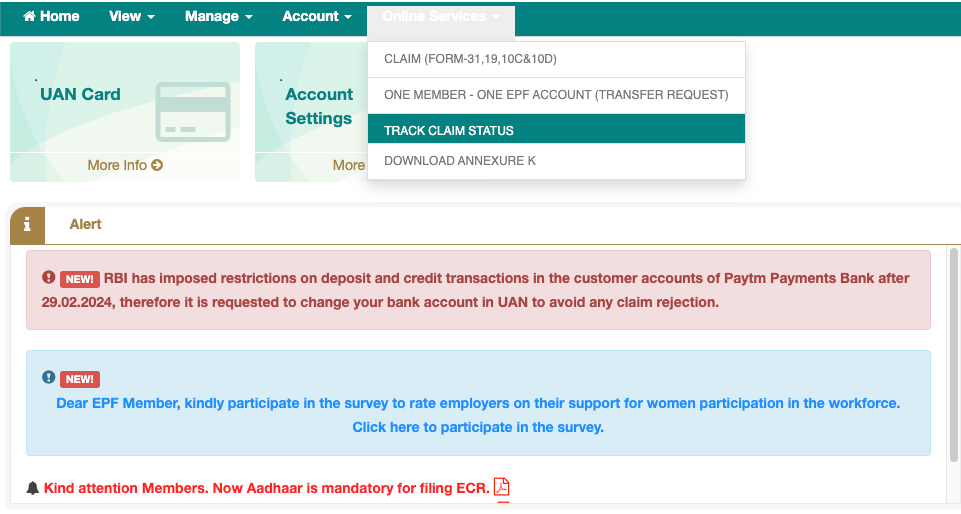

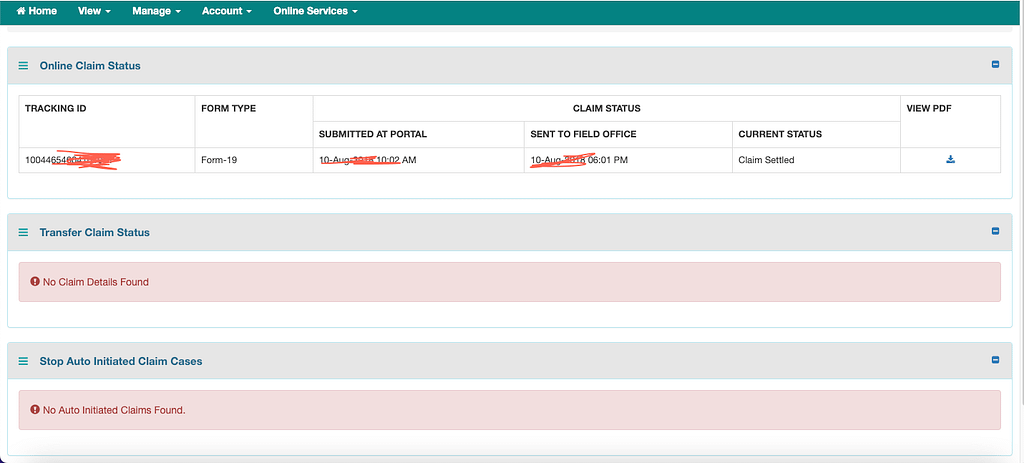

- You need to login you UAN member portal and select “Track Claim Status” from the “Online Services” dropdown list.

- Once you click on “the “Track Claim Status” Your Claim history will be opened and you can easily keeps track of your previous and ongoing status of the claim.

How can we update bank details in EFPO?

If your bank details are not up to date on your EPFO Login portal then you wont be able to withdraw EPF amount. It is very simple to update KYC on EPFO portal. You can follow below process to update KYC online.

- Login to UAN portal ( If you don’t know how to login UAN portal you can read above tutorial where we have explained the complete process to login UAN portal)

- Go to the “Manage” dropdown and click on “KYC”.

- Once you click on “KYC” a new page will appear for you to upload KYC deatils.

- You can choose “Bank”, “PAN”, “Passport” number to very KYC on UAN portal.

- Here on UAN login portal you are not required to upload any documents.

- You just need to enter your documents number it will be automatically verified if all your documents are linked with PAN card.

- Initially it will show you pending.

- Once your employer approves your KYC it will show you approve on the UAN login portal.

FAQ’s – UAN and EPF

What is UAN?

UAN (Universal Account Number) is given to all the EPFO holder to manage their EPF account online. It helps EPF user to track the contribution of EPF amount deposited by their employer’s.

What is the differences between EPF and UAN?

EPF (Employee Provident Fund) and UAN (Universal Account Number) are related to each other, but they serve different purposes:

EPF (Employee Provident Fund):-

- EPF is a retirement savings scheme mandated by the government for salaried employees in India.

- Both employees and employers contribute a portion of the employee’s salary to the EPF account every month.

- The funds deposited in the EPF account accumulate over time and serve as a retirement corpus for the employee.

- EPF withdrawals are permitted for specific purposes such as retirement, medical emergencies, housing, education, etc., subject to certain conditions and regulations.

UAN (Universal Account Number):-

- UAN is a unique identification number assigned to every employee enrolled in the EPF scheme.

- It serves as a single umbrella for multiple EPF accounts that an individual may hold over their employment tenure.

- With UAN, employees can easily manage and track their EPF accounts online through the Unified Portal provided by the Employees’ Provident Fund Organization (EPFO).

- UAN facilitates easy portability of EPF accounts when changing jobs, as the same UAN can be linked to the new employer’s EPF account.

What benefits does the UAN Login Portal offer?

The UAN Login Portal offers a range of convenient facilities for managing your EPF account efficiently. Some of the key features include:

- The portal provides easy access to your EPF account details anytime, anywhere.

- You can update your personal information, such as contact details and nominee details, online through the portal.

- With UAN, you can link multiple EPF accounts under a single umbrella, making it easier to manage your retirement savings.

- You can initiate the transfer of EPF balance from one employer to another seamlessly through the portal.

- You can submit various EPF claims, such as withdrawal, partial withdrawal, and pension settlement, online through the portal.

Overall, the UAN Login Portal simplifies EPF account management and provides easy access to various services, ensuring a hassle-free experience for EPF account holders.